Basic stock analysis: requesting and plotting data

Created: 19 April 2017

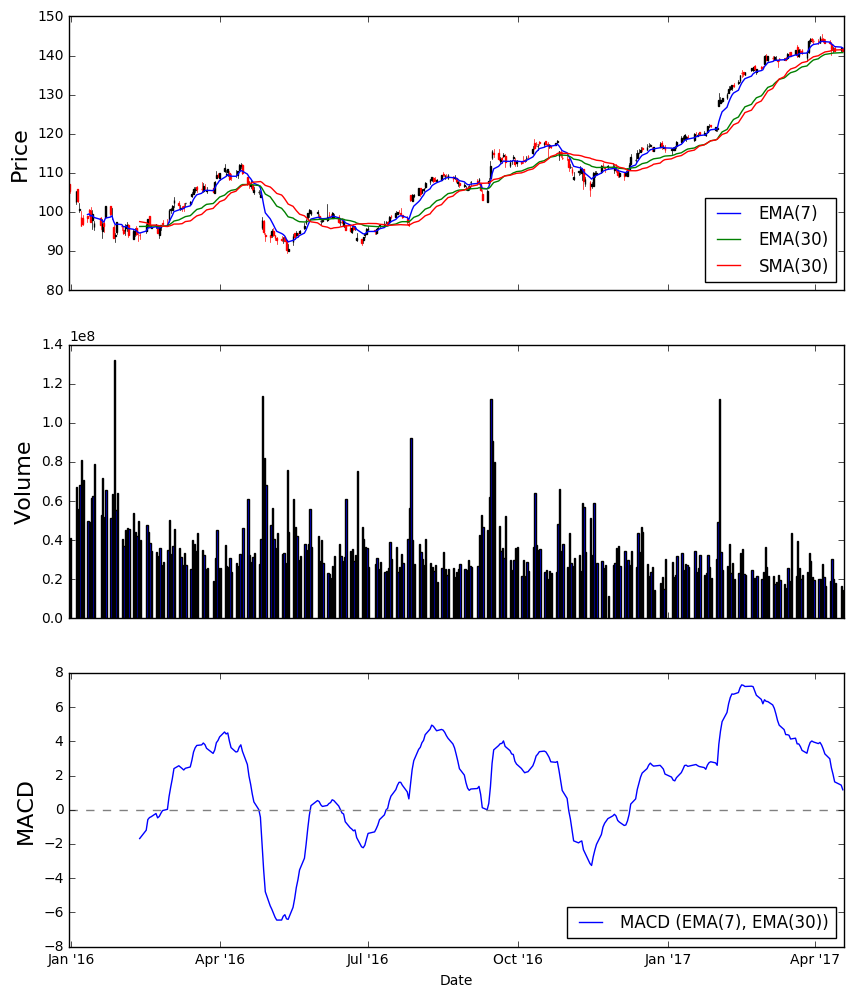

Visualizing historical stock data

The following code shows how to get historical data of a stock from Google Finance (or Yahoo Finance) and plot a candlestick chart with simple moving average (SMA), exponential moving average (EMA), and Moving Average Convergence Divergence (MACD).

The code is an expansion of an answer in this Stack Overflow thread.

The code is written in python 3.5.2.

# import necessary libraries

%matplotlib inline

import pandas_datareader.data as web

import pandas as pd

import matplotlib.pyplot as plt

from matplotlib import dates as mdates

from matplotlib.finance import candlestick_ohlc

import datetime as dt

Getting data from web

# request and reformat data

symbol = "AAPL"

data = web.DataReader(symbol, 'google', '2015-12-31', end = dt.datetime.now()) # use 'google' or 'yahoo' to pick the data source

data.reset_index(inplace=True)

data['Date']=mdates.date2num(data['Date'].astype(dt.date))

Define moving average models to plot

# setup moving average models

x = data['Date']

EMA_1_span = 7

EMA_1 = data['Close'].ewm(span=EMA_1_span,min_periods=EMA_1_span).mean()

EMA_2_span = 30

EMA_2 = data['Close'].ewm(span=EMA_2_span,min_periods=EMA_2_span).mean()

SMA_2_span = EMA_2_span

SMA_2 = data['Close'].rolling(window=SMA_2_span,center=False).mean()

MACD = EMA_1 - EMA_2

Plot stock data

# plot

fig, (ax, ax2, ax3) = plt.subplots(3, sharex=True, figsize=(10,12))

# plot candlestick, SAM, EMA in subplot_1

candlestick_ohlc(ax,data.values,width=0.5);

p1 = ax.plot(x, EMA_1, label='EMA(' + str(EMA_1_span) + ')')

p2 = ax.plot(x, EMA_2, label='EMA(' + str(EMA_2_span) + ')')

p3 = ax.plot(x, SMA_2, label='SMA(' + str(SMA_2_span) + ')')

ax.xaxis.set_major_formatter(mdates.DateFormatter('%Y-%m-%d'))

ax.xaxis.set_major_locator(mdates.MonthLocator([1,4,7,10]))

ax.xaxis.set_major_formatter(mdates.DateFormatter("%b '%y"))

ax.set_ylabel('Price', fontsize=16)

ax.legend(loc=4)

# plot volume in subplot_2

ax2.bar(x,data['Volume']);

ax2.set_ylabel('Volume', fontsize=16)

# plot MACD in subplot_3

ax3.plot(x, MACD, label='MACD (' + 'EMA(' + str(EMA_1_span) + '), ' + 'EMA(' + str(EMA_2_span) + '))')

ax3.axhline(0, color='gray', linestyle='--')

ax3.set_xlabel('Date')

ax3.set_ylabel('MACD', fontsize=16)

ax3.legend(loc=4)

Obtaining real-time stock price from Google Finance

The code below shows how to get real-time data of a stock from Google Finance page.

It is a modified version of files from this Github repository.

# import libraries

import urllib.request, time, re

Create a function to call stock data from Google Finance

# define data acquisition function

def fetchGF(googleticker):

url = "http://www.google.com/finance?&q="

respData = urllib.request.urlopen(url+ticker).read()

# search for the tag with ref id of the stock and get the displayed price and currency

price=re.search(b'id="ref_(.*?)">(.*?)<', respData)

currency=re.search(b'Currency in (.*?)<', respData)

if price:

# get the price and re-format displayed text

# group 1: ref id of the stock in the html page, group 2: price

tmp=price.group(2)

q=tmp.decode().replace(',','') + ' ' + currency.group(1).decode()

else:

q="Nothing found for: "+ googleticker

return q

Call and display real-time price of a selected stock

# pick stock and display the current price

ticker = 'NASDAQ:GOOG'

print('As of '+ time.ctime() + ' local time, the price of ' + ticker + ' is ' + fetchGF(ticker) + '.')

As of Wed Apr 19 16:24:20 2017 local time, the price of NASDAQ:GOOG is 841.01 USD.

Closing note

The codes above show basic of requesting historical and real-time stock data as well as plotting charts/indicators. With some effort, the process could be made less tedious and more automated.